As layoffs accumulate from big profitable companies across the board: Boeing, Microsoft, DHL, etc. I've met with a number of people who have worked at these companies for 10+ years and now find themselves out of work for the first time and don't know what to do about it. These big companies historically offer people the illusion of security -- they're supposed to be safer than small companies. And while big companies and their big piles of cash do offer security, I'm beginning to wonder if it's not safer to be in a small profitable company than a big one. At a small profitable company, your contributions are likely more critical and impactful than in a fortune 500 company.

Be generous, but not stupid

This was the advice I gave an entrepreneur about leaving his company after 3 years of hard work without financial success. The entrepreneur was in the midst of dealing with the emotionally challenging time of "breaking up" with his partners and was asking me for advice. I told the entrepreneur that separating from a company that one founded is hard to do and it is precisely at that time that you want to be more generous than not with your co-founders without violating the -- don't be stupid rule.

Investor advice: Put your helmet on

Last week I used stepping in dog shit as a metaphor for the current climate -- you can read that post here.

Today, I have a different metaphorical story. Just before Christmas, it snowed 6 to 8 inches in Seattle. That's a lot of snow for a city that can't handle 1 inch of snow. With the snow, the roads got shut down, and the kids went sledding on all the hills. My daughter was having a great time bombing down the hills until 5PM -- dusk was setting in, visibility becoming a challenge and she sledded right into a fire hydrant. She knocked herself out. Fortunately, we didn't have to go to Children's hospital and she was fine. Why in god's name did we not require her to wear a helmet?! In the excitement and newness of the snow, we just plain forgot -- and lost site of the risks. We're the kind of parents that always make her wear a helmet when she's biking and now she's sledding with less control than she does when she's on her bike? Oops. It only takes a second.

Which brings me to today -- It feels like investors got hit in the head and knocked out in Q4 of 2008 and now are only reminded of the risks of investing. Everyone is taking every protection possible and many are simply avoiding the activity all together. My suggestion is make sure you have your helmet on, it's a bit dangerous, but the sledding is still fun.

Newt Gingrich knew what was going on

The below is from the hugginton post....I think it's interesting comment.

After making a list of political analysts that thought Barack was a flash in the pan and that the political race was between Hilary and everyone else....The author points out that Newt Gingrich knew what was going on.

So, whose compass was registering properly two years ago? How about former House Speaker Newt Gingrich?

"Well, Abraham Lincoln served two years in the U.S. House, and seemed to do all right." Newt Gingrich, "Meet the Press," NBC, Dec. 17, 2006, when asked about Obama's lack of experience.

"I do think every Republican ought to look at the reception Barack Obama got a week ago [during his very well-received first visit to New Hampshire]... The interest in him tells you something about Americans more than it tells you about him." Newt Gingrich, Dec. 15, 2006.

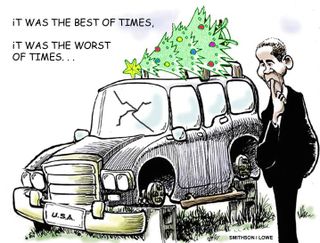

Welcome Barack Obama

How appropriate is it that Obama's inauguration is the day after MLK day?

Have you stepped in dog shit?

I just went out to lunch and had the good fortune of stepping in some fresh, smelly dog crap. I cursed, stopped, took my shoe off, wiped the crap off, washed my shoe and put it back on and kept walking to lunch. I smiled to myself as I thought about the shit storm that investors and entrepreneurs alike have been living through for the past 4 months or so. The metaphor of stepping in dog shit seems an appropriate one to share. I'm witnessing people at the various companies I work with stop, swear and attempt to wipe off the shit. Some are successful and seem to be walking forward. Others are less successful and are still trying to get the dam dog doo off their company's balance sheet and p&L. Losses are behind. You can't recoup them. Don't try -- it's likely to make the matter worse. As soon as you can walk forward -- no matter how slowly and no matter how much cursing.

It's easy to get in, but can you get out; Investment opportunities abound but what about exits?

We've been busy at founder's co-op looking at deals but like many investors we didn't make any new investments in Q4, 2008. We've got a couple deals in the pipeline that we're excited about and may get done in the next month or so. If we do the deals, I'll be sure to let you all know. One of the things, that's on my mind -- like many of the investors out there -- is exits in the future. Expectations amongst entrepreneurs have come down and thus, deals are increasingly investor friendly. That's good.

But the question of what happens after an investment is made and a company grows are more uncertain today than ever before. Another way of putting it is that getting into deals is all too easy but getting money out on the back end is hard. It's impossible to have an answer to this -- and one either has faith that there will be a back end in 3 to 5 years or not. We're keeping the faith --and hopefully, making some bets in the near term but the m&a market of the future is on our minds.

Does America need a dictator?

George Bush used the executive office for lots of initiatives and activities that I disagreed with at the core of my being. I found myself in shock and horror as he (and his cronies) used the executive office to initiate war in Iraq, to undermine basic civil rights and human rights (think Guatanamo bay and civilian wiretapping), and to cut taxes in the face of rising spending -- he used politics of fear effectively and moved to centralize power in the executive branch more than any previous president (to my knowledge). He did all this and much, much more. And I think he'll go down in history as the worst president in American history for what he did...and most people won't focus on how he did it.

Now, Barack Obama comes along -- someone that many people believe in. I'm beginning to wonder if the country doesn't need Obama to use even more centralized executive powers than George Bush used in order to be effective in the current situation. I'm nervous that Obama's inclusive liberal decision making approach is going to get more mired in the political system than George Bush's approach. This, at a time we absolutely need decisive leadership. In my opionion, Barack would make a great CEO of America -- if only our system granted him that authority.

I'm rambling a bit....but I'm wondering whether America doesn't need more of a benevolent dicatator now more than ever?

And I'm wondering about the the irony that the last President attempted and wished for dictator like powers more than any other president previously and is, in my mind, to blame for much of the mess we find ourselves. What's that say about America's political system?

Really funny prank calls

Quick presentation for entreperneurs

I ran across this presentation and thought I'd call it out as a quick read for up and coming entrepreneurs. I don't agree with everything in the presentation but think it's worth reading -- anything that's title "quick and dirty" is worth reading no? Check it out here.

Happy new year everyone!

Drive safe. Wear a hard hat.

The holidays are a good time for planning

I've spent a good portion of my day today and yesterday with Tom Staples of Cooler Planet reflecting on 2008 and making plans for 2009. The process of figuring out the strategic priorities for a company can be a bit of a dizzying process. It's easy to focus on tactics -- make a list of the things that should be done or you've thought about doing and haven't gotten to yet. Tactics for Cooler Planet include providing more value for our installer base with additional products, providing more value to consumers with more energy efficient offerings and information, increasing traffic through a variety of strategies, etc. But tactics don't really allow you to answer questions of priority and more importantly, what you won't do. And that's where strategy comes in -- what is this company, what market are we in, who are our customers, what are the strengths and opportunities face the company. The good news about not having a lot of cash reserves is you can be very focused and very tactical and drive the company hard toward increasing cash flow (and thereby increasing cash reserves). So Tom and I have gone round and round -- and we're not through it yet but the strategic conversations have placed the tactical decisions in a different and clearer light. So, I'm encouraging all my companies and readers to spend some of the holidays planning for 2009.

Snowed in

Nothing like a real snow storm to slow everyone down. 12 inches of snow in Seattle. It's pretty and the sledding is good but I wish people in the NW knew how to drive in the snow a bit better.

Junior Prom Photo...take 2

My junior prom date, Debby Shapiro, has posted our junior prom photo on facebook. Here it is for all of you to smile, cringe, laugh, cry at....comments are welcome. You can see the photo better here.

Sock and awe

Worth checking out the onine game about President Bush and the shoe incident. Check it out here.

Happy holidays

Legal bill I received today

Legal services: 0.1 hours @ $350/hour = $35 (see attached timesheet)

Expenses: None.

Total Amount Invoiced: $35

This was the entire bill for the month. I'm not sure exactly what to say about this bill. I think the bill kind of speaks for itself. To get to the point where they are billing me for 1/10 of an hour is beyond my comprehension. And lawyers wonder why there are so many lawyer jokes!

I don't doubt that there was a phone call that took place, the lawyers billing system can attest to that. But what did we discuss? Was the call 4 minutes or 7 minutes or 5.24 minutes? Grumble. Grumble.

Cash flows jingle (sung to the tune of jingle bells)

Oh, Cash flows, cash flows,

Cash flows all the way

Oh, what fun it is to make

a buck more than you weigh

Cash flows all the way

Oh, what fun it is to make

a buck more than you weigh

That's as far as I've got.

Tiger21: a peer to peer investment club

I've decided to chair the Seattle chapter of Tiger21. The organization is a group of high net worth individuals who meet monthly to discuss all things financial in their life and world. The goal of the group is to assist individual members in becoming more knowledgeable and educated about managing their financial life. i.e. increase investment returns and limit risk. The group has some roots in Vistage (formerly known as TEC) , YPO, and EO (formerly YEO) -- but is unique in its focus on financial matters. There are currently fifteen TIGER 21 learning groups,

representing more than 165 investors, with investable assets over $10 billion.

Founded in New York, TIGER 21 now has investor groups in New York, California,

Florida and Texas....and now Seattle.

I was fortunate to be a recent guest for part of a meeting at the San Francisco Tiger21 chapter and was so impressed and inspired by what I learned that I decided to chair the Seattle group. I learned from 8 other competent individuals about what each of their view and actions had been since the October collapse of the stock market. It was highly educational and contained information that influenced how I've managed my investments in the last 30 days. The notion of having this input on a regular basis in Seattle excited me -- so I'm chairing the group. Feel free to email me if you have questions or interest about what I'm doing.

You can read about Tiger21 at its website or in some press articles in the New York Times, CBS market Watch, the Miami Herald, the London Times etc. You can also see the press article in the Seattle Business Journal too.

A breeze blew in, I ate a grape, and I jizzed in my pants

I knew you would like that blog title ....and you'll like the video even more. If you're under 18 or easily offended do not watch the video

You know I debated about whether I should post this content on my blog or not. I hemmed and hawed. But in the end, I can't resist. Forgive me, if I have a sense of humor....and I just figured that in these dark scary economic times we all can use a good chuckle or two a day. This content from Saturday Night Live made me lough out loud.