Last Wednesday, I tipped the scales at 200.5 naked. That was my lightest weight yet this year...and probably my lightest since 2000. I then went on a long weekend in Vegas. I ate and drank without thinking. I had chocolate croissants, scotch, and 4AM snicker bars. It was an indulgent weekend -- I was there celelbrating the sale of Kefta with the management team. I've returned to Seattle reality and worked out this AM for the first time in a week. My trainer had me due sprints. I nearly puked. I haven't gotten on a scale because I know what it's going to say. So, I'm back on the saddle. 2 steps forward and 1 backward for me and my fat ass.

Transferring old file formats

Now that I'm back on the Mac, I was thinking about transferring a handful of old files that are on my Mac SE. Big problem -- no one has 3.5 inch floppy discs anymore....and even if you (or I) did, once you get tthe data onto a disc, how would you ever be able to read the disc on a new computer --i.e. there are no more disc drives. I may be stating the obvious but it's not a probelm I've encountered in the domain of computer data.

I'm reminded of the advice my father in law gave me recently. He suggested I go and buy a new VHS before the players go into extinction. That way, I'll always be able to read my old catalog of VHS tapes. He insists that it's much easier than trying to transfer all those tapes.

Does anyone know how to do deal with this floppy disc and data transfer problem?

Converting from PC to the Mac

I threatened to make this switch months ago and well -- I finally did it 2 weeks ago. I am now 100% on the Duel 2 GHz Power/PC G5 with 1.5 GB DDR SRAM.

With the first 2 weeks of interface transition idiocy behind me, the switch in retrospect was relatively painless. My biggest problem so far has been re-learning keyboard shortcuts for certain things. My second biggest problem is that Rhapsody doesn't work on teh mac and I used to like to use that service a lot.

Much thanks to Chad for helping me through this transition!

Returning to the office

I was away the end of last week and thus didn't blog. Sorry for not letting you all know in advance. I'm catching up right now3 and digging out of the email hole. I should be back up and operational in 24 hours.

LineBuzz Rocks

I just installed a new widget on my blog called LineBuzz. It's a simple but very powerful concept for bloggers: it allows inline commenting on a blog post. I just installed it and am pretty excited about the application ....please try it out and let me know what you think. My hunch is that this thing has viral legs....let's watch it run together. It was created by a new friend of mine in Seattle -- Mark Maunder....a cool guy I met at the Seattle OpenCoffees.

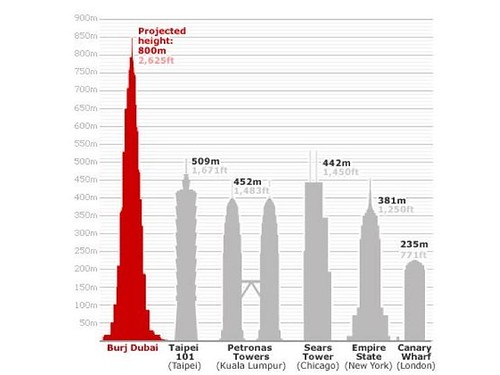

Dubai construction

This graph speaks for itself.

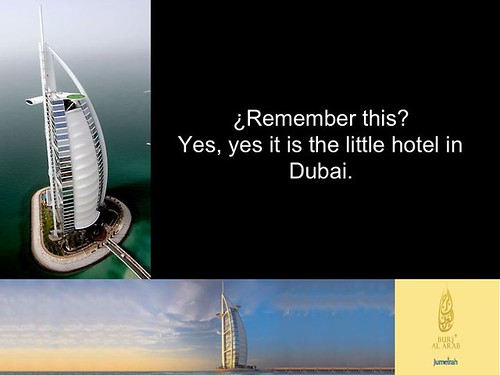

A small Dubai hotel

I saw a photo of Nadal and Agassi playing on top of this hotel !

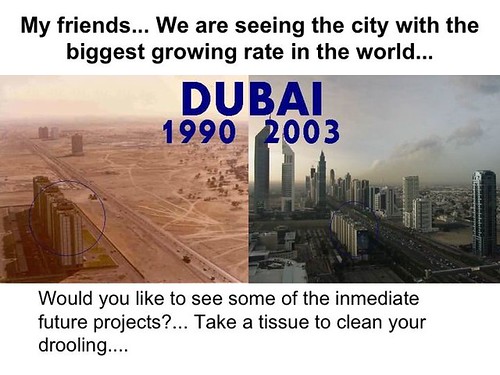

Dubai pictures

Blogging is awesome. I made a post yesterday about the random thought of going to Dubai and New Zealand. I had a reader from New Zealand invite me to coffee and had someone send me an awesome power point about Dubai. Check out these photos of Dubai !

My 40th birthday revisited

I'm still planning on taking time off sometime next year to celebrate my 40th birthday. I've been thinking about going to New Zealand, Nepal, or Italy....but someone just suggested Dubai! It sort of caught me off guard. I don't know the first thing about the place ...other than they have man made islands. Can anyone tell me positive or negative things about Dubai as a place to visit?

Seattle Entrepreneurs Open Coffee home page for the year

I just set up this page on upcoming for the Seattle Open Coffee weekly meetings we've been having.

It's crazy but Upcoming doesn't let you set up recurring appointments so I put this out until December ....and Meetup wants to charge 10.99 per month to organize this event.

Sorry Scott -- but at that price I have to go with your competitor which is free even if they don't let me make recurring appointments. Scoot -- is Scott Heifferman the CEO of MeetUp and a friend.

All are welcome:

Every Tuesday, 8:30AM - 10:00AM, Louisa's at 2379 Eastlake Ave. E, Seattle

Emotion, blogging, business

I just read a great post by a young entrepreneur / author named Ben Casnotcha. He's got a great blog here. His post about the lack of emotion in many blogs is excellent (like many of his posts. I encourage you to read it.

I've thought about this phenomena in the context of my own blog too. How much of my personal life to share ....not to share. At teh root of it, I've been reluctant to get into important life matters around marriage, sex, parenting, friendship, etc because blogs are inherently public and -- well-- I don't want to write something that I'd regret being public later.

That said I think there is a whole lot of undocumented and unshared wisdom in the minds of our elders about this thing called life and wish I could find more of it online and in blogs. If anyone has suggestions of blogs to read on the topic please let me know.

Judy's Book and Mpire

John Cook of the Seattle Times has been writing here about the similarities between Mpire and Judy's Book. I actually think that the two companies are more complimentary than competitive. Judy's Book is really about local shopping. We are a destination site for you to find out what's on sale near you. If you want to do shoe shopping this weekend -- and you're wondering what's on sale / where near your home....i.e. where you can get a deal on shoes then Judy's Book is the place for you. Mpire -- as I understand it, is about shopping analytics of new and used products. You want to know what's happened to the price of ipods over time then Mpire will deliver this to you. I'm looking forward to seeing how both services evolve over time.

Seattle Open Coffee Success

This was the fourth meeting of Seattle Open Coffee. It has totally exceeded my expectations at this point. Today was the largest showing yet....17 people. At this point the events are primarily social and networking. People come -- some new faces each week and some regulars. We have coffee and breakfast and chat about our start ups /early stage companies. I'm not sure exactly what to do with these events -- whether to add any structure at all or not. In the meantime, they're fun events and there seems to be a group of regulars who can carry this forward. So the experiment continues. If you've got ideas about what we should be doing at these events please send it to me....

This OpenCoffee is held each week on Tuesday at 8:30AM at Louisa's. See you next week.

A new home page!!

If you're wondering what we're up to at Judy's Book -- I think our new home page tells the story well. Check it out!

A sample term sheet for a bridge note

This is an outline of a term sheet for a bridge note. I thought I'd post this so people could see a real life example. I'm no lawyer so don't just copy and use...or if you do -- copier beware. Also, this will probably be my last post on bridge notes for a while....I'm going to move onto other topics :-)

Issuer: XXX Corporation (“Company)

Investors: Accredited Investors acceptable to the Company which will invest a minimum of $25,000 (unless otherwise approved by the Company) (“Investors”)

Type

of Security: Debt convertible (“Notes”) into the same stock class, share price

and terms as the next round of equity investment of a minimum of $2,000,000,

including conversion of this bridge financing (a “Financing”).

Note

Provisions

Amount of Investment: Up to $500,000, subject to increase at the discretion of the Company.

Closing: Month XX, 2007 Term: 12 months from the date of issuance of the first Note (“Maturity”).

If

the Company is acquired prior to Maturity or the next Financing, then the

principal and accrued interest automatically converts into Common Stock at a

price equal to the price established in the transaction, minus a 25% discount;

provided that if the Company acquisition valuation exceeds $12M, then such

discount shall be the greater of 25% or that discount which is needed to result

in the Investors converting at a $12M acquisition valuation.

If the Company fails to obtain a Financing by Maturity or the Company is not acquired prior to Maturity or the next Financing, and the Note remains outstanding at Maturity, the Company shall have the option to repay the Note in full or to convert the Note into Common Stock at a $4M preconversion Company valuation.

Additional Note Terms: Company may not prepay the Note prior to Maturity. Payment after Maturity is upon ten days prior notice to Investor.

The Notes are unsecured.

The Notes will be subordinate and junior in right of payment to the prior payment in full of all Senior Indebtedness. Senior Indebtedness consists of any existing and future commercial bank lines and equipment lease lines, along with such additional or replacement commercial loans and equipment leases that are subsequently approved by the Board of Directors.

Other

Matters

Documents: Counsel to Company shall draft form of Notes.

Closing

Conditions: Closing subject to execution of definitive legal documents

When to use a bridge note...

I've seen a number of entrepreneurs using bridge notes as an alternative to seed or series A

rounds – they’re using them when they do not have sight on a real institutional

round. Bridge notes should not be used as way

to finance a company without putting a valuation on the company.

In my opinion, convertible bridge notes are best used when

the next round of financing is visible and the company needs a bit of cash to

hold itself over to the next round. I do believe that's why they're called "bridge" notes.

bridge notes again!?

I don't buy the typical argument that entrepreneurs like myself have given to angel investors re: convertible bridge notes.

The typical argument (I hear and have made) in favor of bridge notes is that the entrepreneur wants to avoid "negotiating" a valuation with angels. Entrepreneurs will say:

- It's too early to set a valuation.

- Rather than "fight" about valuation today, let's put that off until some venture capitalist comes in and sets the market valuation.

Here's why I don't buy those arguments....when a venture capitalist comes in there's not going to be much of a fight on valuation. Price in early stage deals (Series A), typically are in the same zone. Venture capitalists know what market rate is and generally stay within that range for early stage companies. So, in my mind, these entrepreneurial arguments amount to effective delay tactics and surface all the problems I wrote about yesterday when it comes to bridge notes. It's much more straightforward to establish a fair valuation for the company in these seed situations and sell the stock. The valuation should not be a fight with angels either ....both sides either agree to a deal or don't. It's pretty straightforward. My belief is that entrepreneurs (cleverly) want to minimize dilution and so they use bridge notes to carry the company to a higher valuation. But as someone, who has and is willing to take the risk of really "early" money -- I believe I should get paid for that risk as an angel investor.

It's important to note that I think there is a role for bridge notes in small company financings....it's just not how they're being used most of the time today.

Disclaimer: My comments on bridge notes are specifically in relation to the use of bridge notes as a substitute for seed equity financings.

My commute just got a whole lot worse

For those of you who know the geography of Seattle, you know that there are a few small but very important bridges that connect the city together. This is a picture of the university bridge which is part of my daily commute. Normally, my commute is about 10 minutes. I'm expecting my commute to be close to an hour over the next month while this gets fixed.

It make s me wonder what is going to happen when the viaduct fails in Seattle before they can agree on what to do to replace it.

The Kefta Story (Part IV)

Part 4 – Lessons learned

- There are lots of lessons to be learned but my top lessons follow:

- Pick your partners carefully. When the chips are down you learn the nature of your partners. Hopefully, they play cleanly and fairly. Some don’t. It sucks when this happens.

- The way Brad Feld played this investment is what makes him such a great venture capitalist. He played it for the long term and was willing to invest a small amount of money even when things looked bleak because it was the right entrepreneurial thing to do. In doing so, Brad managed to retain a relatively large portion of the ongoing company and recover much of his investment.

- Entrepreneurial perseverance counts for a Lot!!

- I don’t know of many start up successes that don’t have moments where the business life is threatened in some material way.

- As an angel investor, seriously consider participating in all the rounds of a venture – especially the down rounds!

- Obviously, it's a rich history to condense into a blog post. Congrats to all the hard working folks at Kefta for a job very well done.

The kefta Story (Part III)

Part 3 - June of 2003 till now

- So after raising 250K of capital, we had to pay out a few tens of thousand of dollars to amicus to buy them out. The company had very limited capital to run operations. The company downsized to the founding team and has been running cash flow positive every since.

- It was a depressing summer of 2003, but the founders never lost hope and never stopped selling.

- Last year, the company did several millions of dollars in sales, was highly profitable and perfectly positioned to capitalize on the exploding market in online personalization.

- In early 2006, the founders were growing tired and as a board we made a decision to either sell the company or raise additional capital rather than to continue to bootstrap the company.

- In mid 2006, Acxiom initiated conversations with the company. A few weeks ago, Acxiom was the lucky buyer of Kefta. I think they got a great deal and a year from now will be thinking that they were lucky to acquire the company. Time will tell.