Even though I predict a big win for Obama today, I can't help feel anxious. I taking the personal position of not watching the election until late tonight as a way of mitigating the anxiety.

My prediction: Obama wins with over 300 electoral votes

And we know this by 10PM PST.

Just wanted to go on record with my prediction.

Prediction made 7PM on Nov. 3, 2008 - 1 day before the 2008 election.

A cardinal mistake in negotiating that wasn't a mistake

I recently had a meeting with an entrepreneur who is pitching me on making an investment in his company. After the meeting, he sent me an email saying he had made a cardinal negotiating mistake in the meeting by revealing to me that his cash position was very, very low. I wrote back to him telling him that I thought his revealing his cash position wasn't a mistake at all. Rather, his sharing that information with me:

Built trust that he was a straightforward, high integrity entrepreneur

Built trust that he was a straightforward, high integrity entrepreneur- Gave me a sense of urgency about making a decision about the investment so as not to lead the entrepreneur on.

East side open coffee on Wednesdays at 8:30AM

If you're interested in an open coffee on the east side -- like bellevue or redmond open coffee -- there's an open coffee on Wed at 8:30AM in Redmond. Details are here

Interview tips for CEOs of small companies

I was teaching a class at the UW last night and we had a interviewer from a big company come in to talk about how to conduct an interview. It was a great class and got me thinking about recruiting. I've long seen recruiting as a critical job of a start up CEO. And I'd thought share some of the tips from yesterdays class.

Note: The tips below are aimed at CEOs who are recruiting SVP and VP level positions as opposed to staff positions.

- Write the press release for the job first. This is something they do at Amazon....and it gets you thinking about one of the key customers of a senior level hire -- the press. It also helps you "vision" the gloating you might make from a great hire....and that's what you want -- a great hire.

- Write a solid job description -- these aren't exercises in beuracracy or tedium. They outline by what factors you'll assess a candidate.

- Focus on the soft skills as much if not MORE than the hard skills. Be specific about the soft skills when you interview. When you say you want a leader who is open and hgih integrity. What exactly do you mean?

- When you intereview a candidate -- don't make up your mind in the first 5 minutes. All you learn in 5 minutes is how you react to a candidate and whetehr you like them (which is important information) You don't learn whether they are qualified for a job or might just be different than you.

- Some key skills to focus on :

- ability to deal with ambiguity,

- a history of demonstrating good business judgement (they're right a lot),

- ability to see the big picture AND dive deep,

- hire and develop the best team,

- adaptive and flexible

Happy Halloween Photo

Republicans crossing over to vote for Obama make me smile

I've been pleasantly pleased and surprised by the public republicans - Colin Powell and Scott Mcclellan - announcing their support of Obama. What pleases even more is I just came from a board meeting in which 3 long term Republicans who have NEVER voted for a democrat declared that they are going to vote for Obama. Tuesday, November 4, 2008 can't come fast enough.

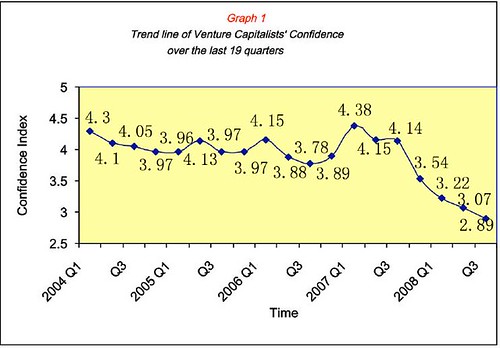

Venture Capital Confidence

Someitmes a picture is worth a thousand words.

I know consumer confidence hit an all time low today -- the lowest in 41 years and given I'm 41 years old, that means it's the lowest in my lifetime!

Strange, intense, disparaging times.

techflash looks cool

Just thought I'd give a little shout out to John Cook and Todd Bishop's new Seattle area tech beat. These guys left the Seattle PI (The PI's loss) and have joined forces with the Puget Sound Business Journal to launch TechFlash. If you want to know what's going on in the Seattle technology scene you won't be able to beat these guys (pun intended). In typical fashion, they launch their site with some interesting news about Bill Gates new company. They're rock star reporters and I for one am happy to see them freed up editorially speaking with their new gig. Good luck guys.

Hot off the press: Seattle Company Cooler Planet forges partnership with American Solar Energy Society (ASES)

Venture Firms: "Closed for the holidays"

Since the great stock market crash of 2008, a number of entrepreneurs raising capital have asked me for advice on their financing.

Venture capitalists won't tell entrepreneurs that they have an invisible sign on the door that says: "Closed for the holidays." But trust me, things are closed tight for the next three months (and perhaps longer).

- Their current portfolio will start to need more attention as the ripple effect of slowing demand hits projections and revenue lines.

- Moreover, their current portfolio may well require more funding and so venture firms will hoard cash for follow on financings.

- With uncertainty about the overall economy and potential exits, venture firms will enter the "wait and see" mode on investments.

All these factors will contribute in the short run to a slowing of new investments.

So what's my advice for entrepreneurs?

Look closely at the assumptions underlying your business plan and the amount of capital you plan to raise. And get prepared to make do with less.

In technology companies, this "bootstrap mentality" isn't that easy to come by.

But in the land of scarce capital resources and easy sources of Series A funding, your business plan is simplified to the "cash flow one step." (?) Get financing from customers in the form of revenues!

Whatever your grand plans, you need to show revenue traction and capital efficiency. Given the choice between growth and survival, make sure survival is taken care of first. Then and only then will you be able to grow.

If this seems harsh, or not what you had in mind, then you, too, should close for the holidays.

Founder's Co-op press

If you're interested in Founder's Co-op, you can read about it here on in TechCrunch an and Xconomy

Chris Buckley resigns from the National Review

Chris is the son of famous conservative William Buckley.

His comment upon resigning:

"While I regret this development, I am not in mourning, for I no longer

have any clear idea what, exactly, the modern conservative movement

stands for," Buckley wrote. Full article here.

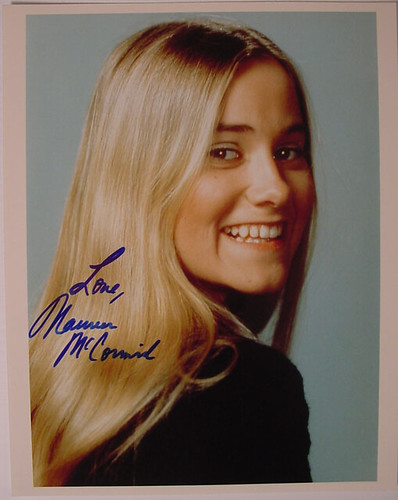

Oh Marcia!

On a little lighter and sadder note than the intensity of the crises facing the world over the last few weeks, I was upset to learn that my childhood fantasy crush Marcia Brady had turned to such an addictive lifestyle. I admit it publicly -- I loved Marcia growing up. I'm glad she seems to have come to terms with herself....but I'm sad that she still doesn't look like the photo here. This is the way I remember her!

Favorite line about the crash of 2008

There are two positions in this world - "cash and fetal". From Mackey, of Fast Money on CNBC

Founder's Co-op mentioned on Techcrunch

Mike Arrington gave us a nice write up here on Techcrunch. I'm excited about Founder's Co-op and in particular working with the list successful Seattle entrepreneurs who are participating as LPs. The thing the article doesn't do a good enough job of articulating is one of the unique components of our fund. And that's the involvement of the proven entrpreneurs -- who are LPs in the fund. These successful entrepreneurs (check out our website for a full list) are going to help guide our investment strategy and play an active role in supporting all the companies we invest in. They're not a passive group of LPs. Rather, we meet 6 to 8 times a year and actively review potential investments and opportunities. Moreover, they play an active role in helping our portfolio grow by providing their expertise, know how, mentorship and rolodexes to making the companies successful.

Mismanaging entrepreneur's expectations

The job of a CEO is to manage the expectations of employees, investors, and the board. I learned to do that pretty well (I think). Now that I'm a full time investor -- I need to learn that my job as an investor is to manage the expectations

- first, of the entrepreneurs we want to do deals with,

- second, the investors in Founder's Co-op and

- third, the broader entrepreneurial community

I don't think I've done a good enough job of number 1 and 3. Today, in particular, I found myself in a conversation with an entrepreneur in whose business I had wanted to invest. I had previously told him that we were going to invest in his business contingent upon customer diligence. As time wore on, the economy (or credit) crashed and I got more familiar with his company's position, I ultimately decided that it would be better if Founder's Co-op didn't invest. That change in investing position -- while very common in all sorts of business deals -- always sucks from the entrepreneurs perspective. I need to do a better job at this! If the entrepreneur I spoke with today on the phone is reading this --please accept my apology -- I know I fucked up in our communication.

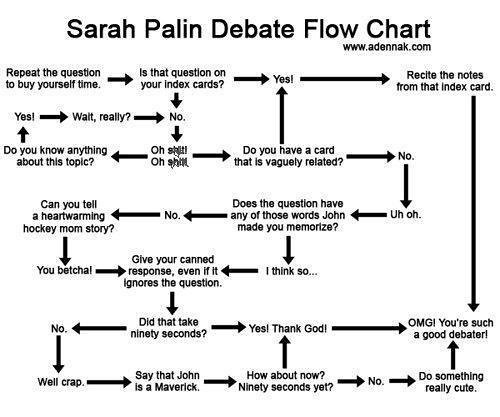

Sarah Palin Debate Flow Chart

To raise capital, make your company smell like money

An alternate title for this post. Use money deodorant. I just had coffee with an entrepreneur who was bemoaning the woes of the fund raising process. He's been unsuccessful to date in raising 600K for his internet company. And he's dismayed and disheartened by success that others are having raising their rounds. He asked me, what is he missing?

I told him investors will invest -- even in this crazy economic climate -- if his deal smelled like money. He then asked what makes a deal smell like money. Below is my list of things that make your deal smell like money (you don't need all of these things but the more the better ):

- Proven entrepreneur -- someone who has sold a business before for 20MM or more

- Proven technologist -- some high level geek at Google, Oracle, or Microsoft

- A determined, hungry entrepreneur with integrity

- An easy to understand product or business, and preferably one that is fun

- A clear path to making money, and preferably proof on making money is even better

- Customer traction -- the more the better, and preferably evidence of accelerating customer traction

- The stamps of big company endorsements always helps -- as customers or partners

Yet another funny palin video

Check this one out.